Introduction: The Importance of Pre seed funding for Startups

The metamorphosis of a startup begins with pre-seed funding. This is vital for the first step without which. It would be difficult to get funding to transform an idea into a business. That is capable of generating revenue. Essentially, it is the first round of financing. That allows entrepreneurs to take the bus by testing the idea. Creating the first prototype or spinning out some work. That can be done in case a larger opportunity arises.

Imagine this: You have a stellar idea that can revolutionize the world or at least make it a little cooler. The problem is that your wallet’s empty. Then, there’s pre seed funding-the unsung hero of the startup world. It’s like that magical friend who believes in your crazy dreams. Would toss some cash your way to make it all a reality. This is early-stage funding that goes way beyond money. It’s rocket fuel for your startup.

But like wildfire spreading across the globe. Turning wild ideas into tech giants of tomorrow. So, are you ready to join the pre-seed revolution and turn your dreams of startups into reality? Stick around, because we’re about to spill the tea on everything. You ever wanted to know about closing that pre seed funding!

What is Pre seed funding?

Pre seed funding is the earliest round of outside capital raised by the startup. Such funding usually occurs when the product or service is still under development. And the amount usually happens to be relatively low as compared to other funding rounds. Such first injections in the form of venture capital are crucial for validating ideas. Prototyping, and conducting necessary market research for a startup.

Pre seed funding is considered one of the first working capital infusions. That the startups need to launch and start building their business ideas. For instance, these involve the development of products, understanding the target market. Or gathering information about customers’ needs; such expenses include building prototypes. Or least viable products (MVPs), gathering information about the target market. Our customer needs key employees or consultants. It also includes legal and administrative costs such as inclusion of business entities, permits, etc.

Usually, the capital involved in pre seed funding. It is less compared to seed funding and Series A. The pre seed funding stage is bestowed upon those startups. Which are at the initial stages of development, having negligible traction or revenues. Early investment, such as pre-seed round is more risky than later stages, since it is not tried or tested before.

Many founding teams use their own savings to fund their seed startups. Loans or investments from friends and family are among the most common sources of pre seed funding. Such are high-net-worth individuals investing in early stages of start-ups. Can provide pre seed funding along with mentorship. These programs usually give seed funding and other resources that make it easier to support start-ups in their early stages.

Prefunding Seed Meaning and Its Importance

A pre-seed round is a source of capital injection to a startup at an early stage. Often when there is no product developed or service available to be offered. It is the ignition that sets off the entrepreneurship trip. And provides the resources needed to convert a mere idea into something that can be seen.

Pre seed funding has proved to be an important source of financing. For a startup in the beginning stages of its development. The development of an MVP with pre seed funding would enable a startup. To develop a product or a minimal version of the product. Or service that would enable them to check market demand. And some form of feedback from their customers. Pre seed funding gives startups a chance to carry out comprehensive market research. This will give them a point of validation for their business idea. An understanding of their target audience, and identification of competitors.

With talented people, a startup can emerge successful. Pre seed funding equips the startup with a strong team along with the skills and experience. Seed Investments help a company to validate business models during the pre-seed stages. While showing potential to raise money for progress and development. A well-conceived pre seed funding round may also be viewed. As groundwork for future funding rounds. It gives the investor an opportunity to realize traction. It validates the business model and does so through the building of a solid team.

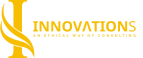

Benefits of Pre seed funding for Startups

Securing the initial sum of capital allows the testing of a business idea to validate whether or not it has a market fit. It is at this stage that the prototype or MVP is created, and any feedback that comes back from potential customers helps shape further developments. A minimum viable product is a result of availing seed funds to the startups. Developing an MVP is essential to present the value proposition and further investment attraction.

Funding availability can be helpful in attracting talent to these startups. With competitive salaries and benefits, startups can build a strong and skilled team to take them ahead.: Most of the pre-seed investors, incubators, and accelerators support mentorship and industry networks, connecting the startup to other entrepreneurs/industrialists who are more experienced in their activity. These can be invaluable sources of insights, advice, and probable collaborations.

Pre seed funding can become a very strategic platform for the startup in securing future funding rounds because the eventual achievement of a successful pre seed funding round may provide an insight into the potentiality of the startup to attract investors at subsequent funding rounds, including seed funding and Series A. The foundation laid by pre seed funding will push the startups towards larger investments in the future.

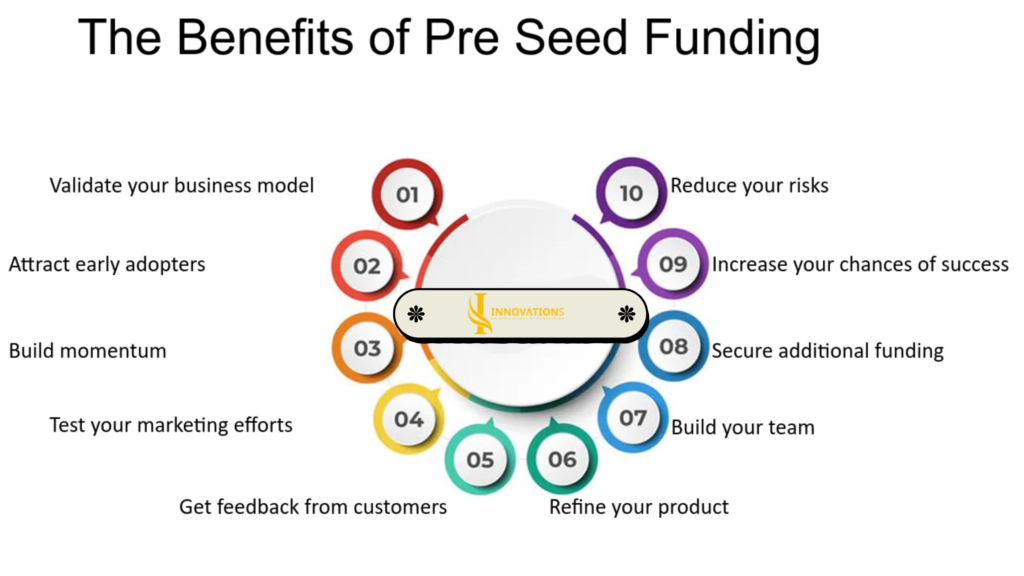

How to Secure Pre seed funding for Your Startup

Your business plan should be comprehensive, clearly outlining the vision of your startup, the market opportunity you’re targeting, your target audience, your financial projections, and your strategy for growth. A well-structured business plan demonstrates an industry understanding and ability to execute your business idea. A prototype or even an MVP is very important in validation of your business concept and taking aboard your investor. Showing them the value and great potential with a first tangible representation of your product or service is quite significant.

Connect yourself with angel investors, incubators, and the communities of startups. Find opportunities for industries through events, conferences, and meetups to reach out to new people and possible investors. Reach out to personal contacts and professional networking groups for potential investors. Connect with friends, family, and colleagues who may be willing to invest in your startup.

Many incubators and accelerators have pre seed funding, among other aids, for startups. Identify such programs in your location and apply, which increases the chances of funds and valuable mentorship. Attend pitch events and startup competitions to pitch your startup to a wide audience that will include investors and industry experts. Pitching may lead to great exposure and networks. Narrate value proposition, opportunities in the market, and financial projections of your startup. Use data and evidence to draw out a strong case and leave an undeniable impression on potential investors.

Pre seed funding in India: Opportunities and Challenges

A wave of successful startups in India has been marked by success and entrepreneurial dynamism, where pre seed funding has become easily available for Indian startups. Many opportunities now emerge in sectors such as technology, e-commerce, and healthcare.

The Indian government, in turn, has taken significant steps to support the startups in the country through initiatives like Startup India. Offering a variety of benefits and incentives. Other than such initiatives, there are many venture capital firms, angel investors, and incubators. That are actively investing in early-stage startups in India.

Indian startups compete on a very competitive platform, and many startups are competing for fewer funds. A startup needs value proposition, market potential, and a strong team to win the confidence of the investor. In some areas, the market might be saturated, and distinctions may become increasingly difficult to prove with increased funding sources.

However, Indian startup landscapes are open for exponential growth and innovation. Opportunities and challenges would therefore augment the chances of pre-seed funding and success in a venture.

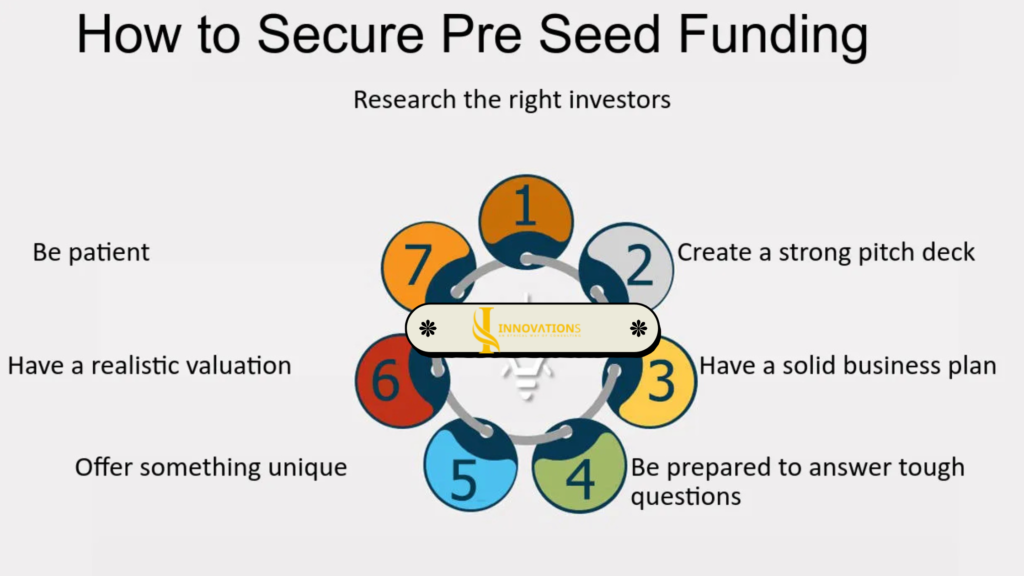

Pre seed funding vs. Seed Funding: What’s the Difference?

Two of the most critical funding levels in the startup funding cycle are pre-seed funding and seed funding. They seem similar but different in many ways.

Pre seed funding is usually offered to the startups at the very initial stages of their development, when the product or service under offer is not yet fully functional. Seed funding typically comes after the pre seed funding is done and disbursed for companies with a certain level of initial traction or with a minimum viable product. Pre-seed funding involves much smaller sums of money. Seed funding involves larger sums of investment. Pre seed funding is normally put in by founders’ savings, friends, family, angel investors, and incubators. Seed Funding is normally provided by angel investors, venture capital firms, and incubators.

Pre seed funding is often for product development, market research, team building, and most initial operational costs. Seed Funding is used for further product development, scale-up of operations, customer acquisition, and preparing the company for the next rounds of funding.

This is the first stage of pre seed funding, which applies to a startup when it is at its development infancy-the focus is more on validating the idea, having a team and a minimum amount of a basic product. Seed Funding is suitable for those startups that have shown some traction, possess at least a minimum viable product and are looking to scale their operations.

In other words, pre seed funding is the spark which starts the engine of a startup, whereas seed funding is the fuel to grow and scale it up. Understanding the difference in both phases of funding helps a startup know the right time to approach each type of investment.

Conclusion: Pre seed funding as the First Step Toward Startup Success

Pre seed funding represents an important milestone in any startup. It is at this stage of the process when the entrepreneur receives first capital to take his ideas out of paper and into reality, verify business concepts, and lay down a base to grow even further.

Pre seed funding for startups has benefits in various ways. To create an MVP and test market demand. To hire talented people who can drive a business forward. Conduct market research and understand your target audience and competencies. Prepare for future funding rounds to have lots of traction and show you can raise bigger investments.

If you’re an aspiring entrepreneur with a great business idea, then don’t wait to indulge in pre seed funding. Hitting the right capital will help you take that step forward and bring your vision to life.

Start today and unlock the ultimate potential of your business idea.