Introduction

No more than a delicate balance. Between the ambition and practicality of the entrepreneur. Startup’s journey marks a most critical decision for a founder. How to finance their venture. The choice between bootstrapping and venture capital. It is going to significantly shape the trajectory of the startup. While providing advantages and challenges unique to each option. Understanding these nuances can lead founders to make informed decisions. Better in line with their long-term goals.

The art of self-funding refers to bootstrapping. Which seeks to finance a business using personal savings, revenue, and loans. It offers complete control and ownership for the founders. Who can maintain their own vision without a controlling influence from anyone else? It also has some weaknesses, like slower growth, fewer resources. And having difficulties scaling. Though this decision – venture capital- or bootstrap-fueled. May seem economically obvious, it’s not a matter of money.

This blog must be the compass guiding you to navigate the pros and cons of each path. And how you can align your funding strategy with your unique vision and goals. Do you want explosive growth fueled by millions of investors? Or do you hope to achieve independence through self-funding? Let’s therefore embark on this adventure together and see which road your startup needs to reach its definition of success.

1. What is Bootstrapping?

In essence, bootstrapping is a business strategy. That develops the entrepreneurial skills of businesspersons. By making use of entrepreneurs’ personal savings. Or internal revenue to grow their startup instead of depending on the money from investors or venture capitalists. It simply calls for building the business from the ground up using your own resources.

This thus provides greater control over the direction of the firms while avoiding dilution. That comes from ownership with the use of outside funding. By bootstrapping, entrepreneurs have complete control over business decisions. As well as avoiding pressures of meeting the expectations of the investors.

Bootstrapping is one very rigorous but innately rewarding ride. One has to have a business idea in which they can wholeheartedly believe, be extremely disciplined and resourceful. Of course, it can also result in creating a sustainable as well as a more profitable business in the long term.

2. What is Venture Capital?

Venture capital is fundraising through investors outside the firm but taking a stake in the company. These are venture capital firms. Which are firms that provide the venture capitalists with access to capital to invest in early-stage companies. With high growth prospects.

Venture capital can be scaled up and expanded at a tremendous scale. Since it provides the founding organization with the necessary inputs to enhance operations. Attract talent and sometimes grow the product or service. But this is inversely related to a dilution of ownership. The equity position held by the founder may be diluted as investors gain equity in the company.

Typically, venture capital firms invest in companies that have shown great potential for growth. And have talented management. They do not only give them financial resources but also mentorship, guidance, and industry connections. At the same time, a relationship between a startup and venture capital firm can be complex. As there are cases in which disagreement will arise about company direction or exit strategy.

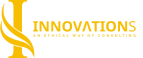

3. Bootstrapped vs Venture-Funded Startups

A bootstrapped and a venture-funded startup both pursue growth, but on different trajectories. A bootstrapped startup is extremely lean in resources. And relies most importantly on internal revenue or personal savings. This means total ownership and, more importantly, sustainable growth.

Bootstrapping lets entrepreneurs maintain control of the direction of their company. They also avoid the pressures from matching expectations of investors upon them. This leads to a more focused and aligned team with higher ownership and motivation in employees. Bootstrapping may lay solid foundations for the business. As it propels entrepreneurs to become more resourceful and efficient with the resources they use.

The venture capital firm funded by venture capital brings a lot of cash earlier in exchange to the investor. And this has the effect of giving up equity and maybe even diluting any decision-making power. Venture capital could be useful when one is trying to scale an enterprise quickly. But it often involves quite a few complexities and pressures. Investors may have expectations of how the company should grow and function. Sometimes leading to disagreements or conflicts.

Actually, the choice between bootstrapping and venture funding. Depends solely on the specific needs and objectives of the entrepreneur. Bootstrapping may be more sustainable and controlled. Whereas venture funding would support the various requirements that could hurry growth.

4. Bootstrapping Advantages and Disadvantages

Advantages of Bootstrapping

- Ownership and control: Bootstrapping maintains ownership for the entrepreneurs. And thus, retains full control over the direction and decisions over their company.

- Less pressure from external investors: Since there would not be investors. Entrepreneurs avoid the pressure of keeping up with investor expectations. Or maintaining tight schedules.

- Gradual sustainable growth: Bootstrapping often takes the form of more sustainable growth. And slower growth reduces chances of high growth and possible failure.

Disadvantages

- Scarce Capital for Growth: Bootstrapped startups might not have some outside funding to fund growth initiatives such as hiring of other talent, expansion into different markets, or the development of new products.

- Lower Growth Rate: Bootstrapping may lead to a less dramatic growth rate compared to venture-funded companies. Since there is only a limited amount of capital available.

- Heavier financial person risk: As compared to venture capitalists and angel investors. Bootstrapped firms’ owners have higher personal financial risks. They are often liable for the firm’s liabilities and debts.

5. Advantages of Venture Capital

The advantages that venture capital offers for a startup are mainly:

- Potential for rapid growth: With large sums of capital. Venture capital may support the rapid scaling of the startup company so that significant growth may be accomplished. This is done through expansion of the business by increasing different operations. Hiring new talent, development of other products, or entry into new markets.

- Experienced mentors and networks: Venture capital firms commonly offer companies. Experienced mentors and networks which are valuable for guidance and support. Connections are becoming more crucial to companies. As access channels to new markets, acquiring top talent, and strategic partnerships.

- Increased credibility: Having a venture capital firm as a shareholder. Increases the credibility of a startup in attracting more finance or partnerships. Especially for competitive startups.

- Industry experts’ access: Generally, venture capitalists are known. To be supplied by industry experts. And experts in their teams supply important information and advice to startups. Thereby providing a company with the ability to make proper decisions. And stay abreast of the rest of the industry.

6. Bootstrap in Business: When to Choose It

Founders want absolute ownership control. Bootstrapping allows entrepreneurs to maintain full ownership and control. The business can be seeded with less cash or can start generating revenues sooner. Businesses requiring smaller initial investments. Or businesses that can generate revenue quickly can be the most ideal for bootstrapping.

If a company prefers to stay independent and has no problem with slower growth rates, then that is a perfect time when bootstrapping can work.

What is a Bootstrap Company?

A bootstrap company is the one which has gained success via independence and resourcefulness. Often, they are described by characteristic features. These are the characteristics and comprise:

Self-sustained companies rely on their internal revenue rather than other external funding. They have the creativity to come up with out-of-the-box thinking. And have found creative solutions for their problems and have leveraged. And unlocked whatever limited resources they have. It is the principal reason bootstrap companies pursue this strategy. To achieve rapid profitability and then seek to make sure that the business model set is sustainable. They will take a very long view of the business and will be ready to invest overtime in growth.

7. Venture Capital: When is the Right Choice?

The startup needs a critical sum of funds to invest in R&D or marketing. If a venture requires significant investment in the research and development of new products. Or in marketing and advertising, venture capital is preferred.

Fast growth is one of the core elements of a business strategy. Venture capital can fuel the very fast scaling and growth of a firm. This may be critical for companies in a fast-paced industry or in highly competitive markets.

For a company looking to scale rapidly in highly competitive markets, venture capital can provide that little extra push. Most startups in competitive markets need to grow as fast as possible to take market share and position themselves well.

8. Deciding Between Bootstrapping and Venture Capital

Whether to bootstrap or venture capital depends on various considerations, such as:

- Your business goals: Do you believe your business will expand in jumps and bounds, or in phases? If your business has an ambition to grow vastly and quickly in the market, venture capital is more suitable. But if you need a more sustainable and controlled approach, then bootstrapping becomes a better option.

- Your willingness to take on risk: Would you be willing to be comfortable with the potential risks and rewards? Arising in venture capital, such as giving away some equity? Venture capital would add some risks and pressures. For instance, from pressure to meet investor expectations and possible dilution of ownership. If you’re risk-averse and don’t like relinquishing control, then bootstrapping fits you better.

- Industry specifics: Does your industry need high upfront capital or rapid scaling? If you’re in a highly competitive industry that demands significant investment. In research and development. Marketing, or expansion, then venture capital is likely to be the needed mechanism to compete. But if you can operate in an industry with less-capital intensity and support a lower growth rate, bootstrapping could be the option.

- Future vision: How much of a control freak do you want to be? Bootstrapping gives you full ownership and control of your company. Venture capital will dilute your equity and bring in some outside influence that will disrupt your operations.

Thus, the final decision between bootstrapping and venture capital depends on your position as well as on what you want in the business. Test these keenly as one of them might just serve your startup

Conclusion

Bootstrapping and venture capital are two of the popular funding approaches that one uses after he or she forms a startup. It offers its set of advantages and disadvantages. And so, which is the best one between the pools varies from what your business aims at. The market conditions, and the personal preferences of choosing between those two.

The bootstrapped one offers more control, less pressure from investors, and a sustainable growth path. But it could also limit the resources and retard the velocity of growth. Venture capital provides access to big bucks. Great mentors, and tremendous opportunity for rapid growth. It can, but also dilute ownership and add greater pressures.

We would need to know whether you should invest based on business goals, competition, and your risk appetite as a whole. This includes capital need, growth rate, and equity being given up, among other requirements. Therefore, it is worthwhile for you to seek a consultation with Innovations Capital. For further information on venture capital financing options. As well as advice from our team to help you take the right route for your startup.