Introduction

The entrepreneurial ecosystem in Delhi is flourishing, and a new concept called venture studios is revolutionising how businesses are built and nurtured. Venture studios like Innovations Venture Studio provide a unique platform that empowers aspiring entrepreneurs to turn their ideas into successful ventures.

The Indian tech startup ecosystem is poised for an exciting year in 2024, with venture capitalists and industry experts closely monitoring emerging trends and opportunities. This article delves into 11 potential predictions for tech startup funding in India for the year 2024.

From the rise of specific sectors to shifts in investment strategies, these forecasts aim to provide insights into the dynamic landscape of entrepreneurship and innovation.

Buckle up as we explore the factors that could shape the future of tech startup funding in the India.

The most fundamental difference between Private equity and Venture capital is the stage of the company in which they invest. Venture capital is about providing seed funding for innovative startups still finding their footing. These early-stage companies often lack revenue streams or proven business models.

VC funding assists entrepreneurs in getting their vision off the ground, providing capital for product development, hiring, IP protection and initial marketing efforts. VCs invest aiming to rapidly scale startups to the point where they can realize returns through an acquisition or IPO.

Private equity, conversely, targets more established companies beyond the startup phase. PE firms inject capital to help mature companies expand further, enter new markets or restructure operations. These businesses usually already have substantiated products, customers and cash flows.

PE seeks companies with robust fundamentals and growth potential that can benefit from capital and financial expertise. The private equity path often sees investors take controlling stakes in businesses and participate heavily in strategy to maximize returns.

11 Indian Tech Startup Funding Trends For 2024

Trends 1: More early-stage funding deals

India is expected to see an increase in early-stage funding deals for tech startups in 2024. The uncertain economic conditions and constrained funding environment in recent years have made investors more cautious about backing later-stage startups with high valuations. However, several factors could drive more investor interest in early-stage startups:

- Lower investment risk: Early-stage startups typically require smaller investment tickets, making it easier for investors to diversify their portfolios and mitigate risks.

- Innovation potential: The early stage is when startups are often developing innovative solutions that can disrupt industries, which appeals to investors seeking high-growth opportunities.

- Attractive valuations: Early-stage startups are usually valued more reasonably, offering investors the potential for higher returns if successful.

- Growing startup ecosystem: India’s vibrant startup ecosystem continues to produce promising early-stage ventures across sectors like fintech, edtech, healthtech, and deeptech.

The types of investors likely to show increased interest in early-stage deals include:

- Angel investors: Affluent individuals investing their own capital are often the first backers of early-stage startups.

- Micro venture capital funds: These smaller VC funds specialize in early-stage investments and can be more nimble in identifying promising opportunities.

- Accelerators and incubators: These startup support programs frequently invest in early-stage cohorts as part of their acceleration process.

- Corporate venture capital arms: Large corporations are increasingly investing in early-stage startups to stay ahead of startup trends and potential disruptions.

In general, a variety of investors may find early-stage startups to be an appealing investment target in 2024 despite economic uncertainties due to their lower risk profile and high growth potential.

Trends 2: Rising focus on profitability over growth

Given the tighter funding environment and economic uncertainties, investors are likely to prioritise profitability and sustainable business models over pure growth in 2024. This shift in focus could have significant implications for Indian tech startups:

- Investors will prioritise sustainable business models: In 2024, investors may become more cautious and seek clearer profitability paths from startups, scrutinizing unit economics, revenue models, and burn rates before investing, shifting from backing startups with strong growth potential.

- Startups will focus more on efficient spending and rationalisation: Startups may prioritize efficient spending and cost rationalization to meet investor scrutiny, streamlining operations, reducing cash burn, and optimizing marketing and customer acquisition strategies for better return on investment.

- Emphasis on revenue generation and monetization: Startups may need to expedite revenue generation and monetization to demonstrate profitability, potentially by adjusting pricing strategies, introducing new revenue streams, or exploring alternative monetization models.

- Longer runway and capital efficiency: Startups may need to increase cash runway and capital efficiency to achieve profitability, which could involve reducing non-essential expenses, optimizing staffing, and negotiating better vendor and supplier terms.

- Consolidation and M&A activity: Startups with poor financials or unsustainable business models may face acquisition or consolidation pressure as investors and larger players seek to acquire promising technologies or talent at reasonable valuations.

While growth will still be important, the ability to generate profits and demonstrate a sustainable business model is likely to become a key differentiator for startups seeking funding in 2024. Those that can strike the right balance between growth and profitability may be better positioned to attract investors in the evolving funding landscape.

Trends 3: Consolidation among startups

The prediction about consolidation among startups through mergers and acquisitions seems plausible in the current business environment. Here are a few reasons why this could happen:

- Funding Constraints: Venture capital funding has become more challenging to secure, especially for early-stage startups. Consolidation can provide a path for startups to pool resources, reduce costs, and extend their runway.

- Market Saturation: In some sectors, there may be too many startups competing for the same market share. Consolidation can help reduce competition and create stronger players with more robust offerings.

- Complementary Technologies/Products: Startups with complementary technologies or products may seek to merge or acquire each other to create more comprehensive solutions, enhancing their value proposition and market appeal.

- Talent Acquisition: Acquiring startups can be a way for larger companies to quickly acquire talented teams and innovative technologies, rather than building them from scratch.

- Economies of Scale: By combining operations, startups can benefit from economies of scale, reducing overhead costs, and improving operational efficiency.

- Regulatory Challenges: In highly regulated industries, consolidation can help startups navigate complex regulatory landscapes more effectively and comply with requirements more easily.

However, it’s important to note that not all mergers and acquisitions are successful. Cultural clashes, integration challenges, and the loss of key talent can pose risks. Additionally, some startups may prefer to remain independent and pursue organic growth rather than consolidation.

The extent of consolidation will likely vary across different industries and markets, with sectors experiencing rapid growth or disruption potentially witnessing more activity.

Trends 4: Emergence of new startup hubs

The prediction about the emergence of new startup hubs beyond major metropolitan areas is a plausible one. Here are a few key points about this trend:

- Cost Advantages: Tier-2 and Tier-3 cities offer lower costs of living and operating expenses compared to major metros. This can be attractive for early-stage startups that need to conserve cash.

- Access to Talent: Many smaller cities have engineering colleges, universities, and technical institutes that can provide a pipeline of skilled talent for startups. Additionally, some professionals may prefer to work in their hometowns rather than relocating to metros.

- Government Incentives: Governments are increasingly recognizing the economic benefits of fostering entrepreneurship. Many states and cities are offering incentives like subsidized workspaces, tax breaks, and funding support to attract startups to their regions.

- Digital Infrastructure: With improving internet connectivity and cloud computing, startups can leverage digital infrastructure regardless of location. This reduces the dependency on being physically present in major tech hubs.

- Success Stories: The success of startups emerging from smaller cities like Bhavnagar (Becoming Human), Dharamshala (DeHaat), and Jaipur (ClearTax) can inspire more entrepreneurs to explore opportunities beyond the conventional startup hubs.

However, there are also some challenges that new startup hubs may face, such as limited access to mentors, angel investors, and specialized services compared to established ecosystems. Overcoming these challenges may require focused efforts from governments, industry associations, and successful entrepreneurs giving back to their regions.

All things considered, the trend towards decentralisation of startup activity is consistent with the growing democracy of entrepreneurship made possible by digital technologies and favourable laws.

Trends 5: Web 3.0 and blockchain startups will be hot

Web 3.0 and blockchain startups will attract significant investor interest due to:

- Disruptive potential across industries

- Growing adoption and mainstream interest

- Enabling decentralized finance (DeFi) and financial inclusion

- Offering data ownership and privacy solutions

Types of startups likely to raise funding:

- DeFi platforms for lending, borrowing, trading

- NFT marketplaces and applications

- Decentralized Autonomous Organizations (DAOs)

- Web 3.0 infrastructure (storage, computing, networking)

- Blockchain-based identity and data management

- Crypto wallets and decentralized exchanges

- Enterprise blockchain solutions (supply chain, provenance tracking)

The potential for innovation and disruption in this nascent sector makes it an attractive investment area.

Trends 6: More funding for climate tech startups

Climate tech startups are expected to gain more funding in India due to the following reasons:

- Importance for India: India is among the countries most vulnerable to the impacts of climate change. With a large population and rapidly growing economy, addressing climate change through technological solutions is crucial for sustainable development and mitigating risks.

- Government Push: The Indian government has announced various policies and initiatives to promote climate tech startups and encourage innovation in this sector:

- National Climate Mission: Launched in 2008, it promotes research and development in climate-related technologies.

- Renewable Energy Targets: India has set ambitious targets for increasing the share of renewable energy, creating opportunities for startups in areas like solar, wind, and energy storage.

- International Climate Finance: India is seeking international climate finance to support its climate action efforts, which could fund climate tech startups.

- Regulatory Sandboxes: Initiatives like the Reserve Bank of India’s regulatory sandbox for fintech can be extended to climate tech startups, providing a controlled environment for testing innovative solutions.

- Global Momentum: Worldwide, there is a growing emphasis on climate action and sustainability, with governments, corporations, and investors increasingly supporting climate tech solutions. This global momentum can benefit Indian startups as well.

- Investor Interest: As the impacts of climate change become more apparent and the need for urgent action increases, investors are likely to allocate more capital towards climate tech startups that offer viable solutions.

- Market Potential: India’s large population and diverse climate challenges present a significant market opportunity for climate tech startups in areas such as sustainable agriculture, water management, renewable energy, and climate risk mitigation.

Some examples of climate tech startups that could attract more funding include:

- Startups developing innovative renewable energy solutions (solar, wind, biofuels, energy storage)

- Startups offering precision agriculture and agritech solutions for water conservation and sustainable farming

- Startups working on climate risk assessment, adaptation, and resilience solutions

- Startups focused on waste management, circular economy, and recycling technologies

- Startups developing low-carbon transportation and mobility solutions

With supportive government policies, global momentum, investor interest, and a vast market potential, climate tech startups in India are well-positioned to receive increased funding in the coming years.

Trends 7: Rise of angel networks outside of metros

The prediction about the rise of angel networks outside major metropolitan cities is a plausible trend, driven by the following factors:

- Successful Entrepreneurs from Small Towns: As more startups find success outside of traditional startup hubs, a new generation of entrepreneurs from smaller towns and cities will accumulate wealth. These successful founders are likely to reinvest their expertise and capital into their local startup ecosystems through angel investments.

- Local Expertise: Angel investors from smaller cities and towns will have a better understanding of the local market dynamics, cultural nuances, and regional challenges. This local knowledge can provide valuable insights and guidance to early-stage startups operating in those ecosystems.

- Connectedness and Community: In smaller cities and towns, there is often a stronger sense of community and connectedness. This can foster organic angel networks where successful entrepreneurs and professionals collaborate to support promising local startups.

- Cost Advantages: With lower costs of living and operating expenses in smaller cities, angel investments can potentially go further, allowing investors to take more calculated risks and support a larger number of startups.

- Untapped Opportunities: Many small towns and cities have unique challenges and opportunities that are best understood by local entrepreneurs and investors. Angel networks in these regions can help identify and nurture startups addressing local or regional problems.

- Reverse Migration: As remote work and digital connectivity become more prevalent, some successful entrepreneurs and professionals may choose to return to their hometowns or smaller cities. This reverse migration can contribute to the growth of local angel networks.

- Government Incentives: Several state governments and local authorities are offering incentives and support for entrepreneurs and investors to establish and participate in angel networks in their regions. These initiatives can further boost the rise of angel networks outside major metros.

While established startup hubs will continue to attract significant angel investment activity, the emergence of angel networks in smaller cities and towns can democratize access to early-stage funding and mentorship. This decentralization of angel investing can contribute to the overall growth and diversity of the startup ecosystem in India.

Trends 8: Focus on B2B Solutions

The Indian startup trend scene is buzzing, and investors are taking note. While traditional leaders like e-commerce remain hot, a new trend is emerging: B2B solutions. In 2024, a whopping 36% funding increase is projected, with enterprise software startups like Capillary Technologies leading the charge. This shift reflects a growing need for efficient business tools. B2B fintech solutions are a prime example, attracting investor interest with their SaaS offerings. The future looks bright for B2B innovation, with a growing focus on data-driven healthcare and AI-powered automation fueling the fire. With B2B solutions taking center stage, the Indian tech startup scene is poised for a transformation.

Trends 9: Growing corporate venture capital activity

The prediction about growing corporate venture capital (CVC) activity aligns with the increasing interest of large corporations in leveraging startups for innovation and strategic growth. Here are some key points about this trend:

- Access to Innovation: Large corporations are recognizing the need to tap into external innovation sources to stay competitive and relevant. Investing in startups through CVC funds allows corporations to gain early access to disruptive technologies, business models, and talent.

- Strategic Alignment: CVC investments are typically made with strategic objectives in mind, such as gaining insights into emerging technologies, identifying potential acquisition targets, or exploring new markets and revenue streams that complement the corporation’s core business.

- Ecosystem Engagement: By setting up CVC funds, corporations can actively participate in startup ecosystems, fostering relationships with entrepreneurs, investors, and other stakeholders. This ecosystem engagement can provide valuable insights and opportunities for collaboration.

- Financial Returns: While strategic considerations are the primary driver, CVC investments also offer the potential for financial returns. Successful startup investments can generate significant returns for the corporation’s venture capital portfolio.

- Talent Acquisition: CVC investments can also serve as a talent acquisition channel for corporations. By working closely with portfolio startups, corporations can identify and potentially acquire promising talent or entire teams.

Examples of large corporations that have established CVC funds or actively engage in startup investments include:

- Tech giants like Google, Microsoft, Amazon, and Intel

- Automotive companies like BMW, Daimler, and General Motors

- Industrial conglomerates like Siemens, Bosch, and Honeywell

- Financial institutions like Goldman Sachs, Citigroup, and Barclays

- Consumer goods companies like Unilever, PepsiCo, and Coca-Cola

In India, corporations like Reliance Industries, Tata Group, Mahindra Group, and Aditya Birla Group have also established CVC funds or made strategic investments in startups.

As corporations continue to prioritise innovation and disruptive growth strategies, CVC activity is expected to grow further, providing startups with access to capital, industry expertise, and potential partnerships or acquisitions.

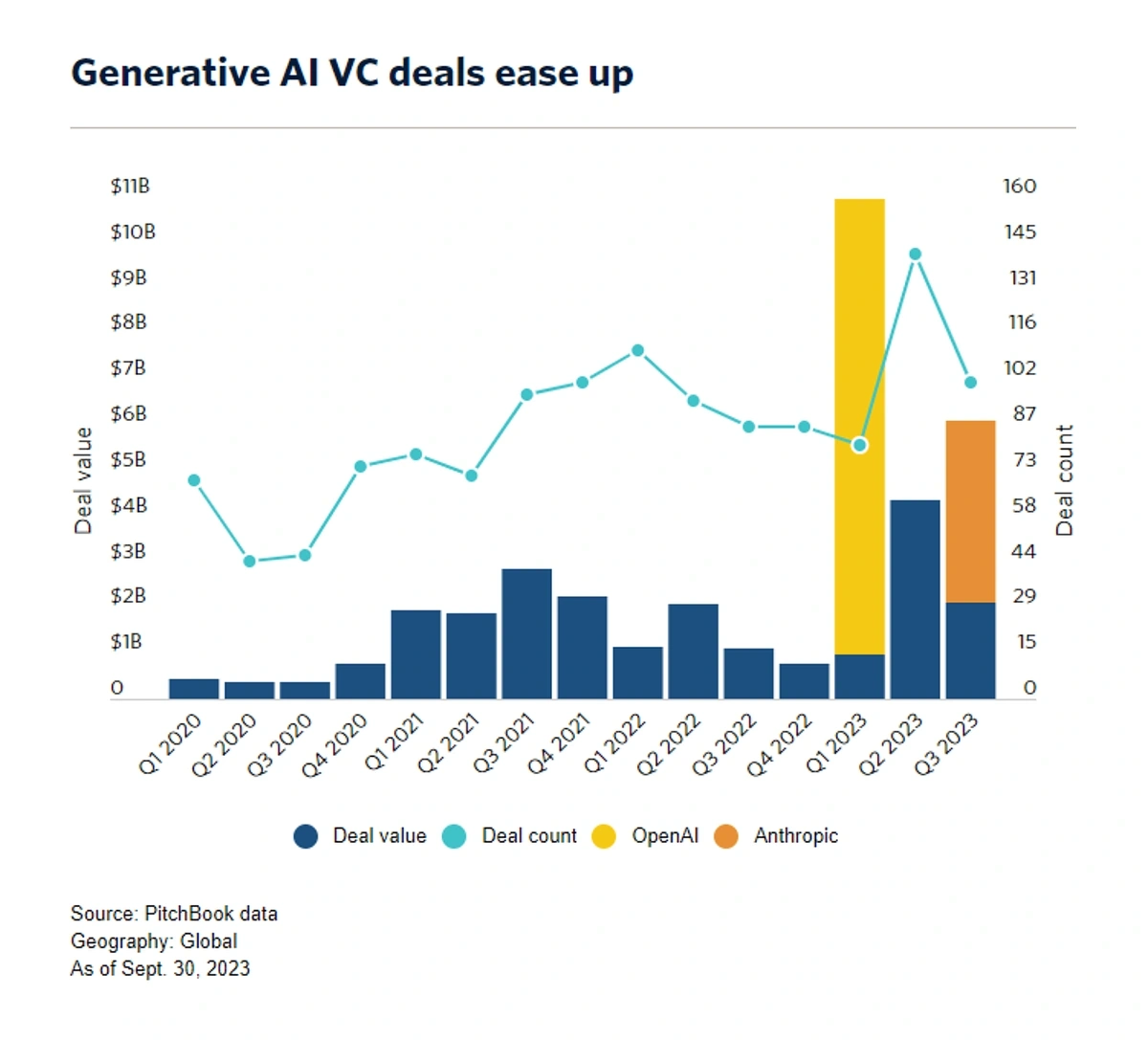

Trends 10: Highs And Lows In Generative AI Funding

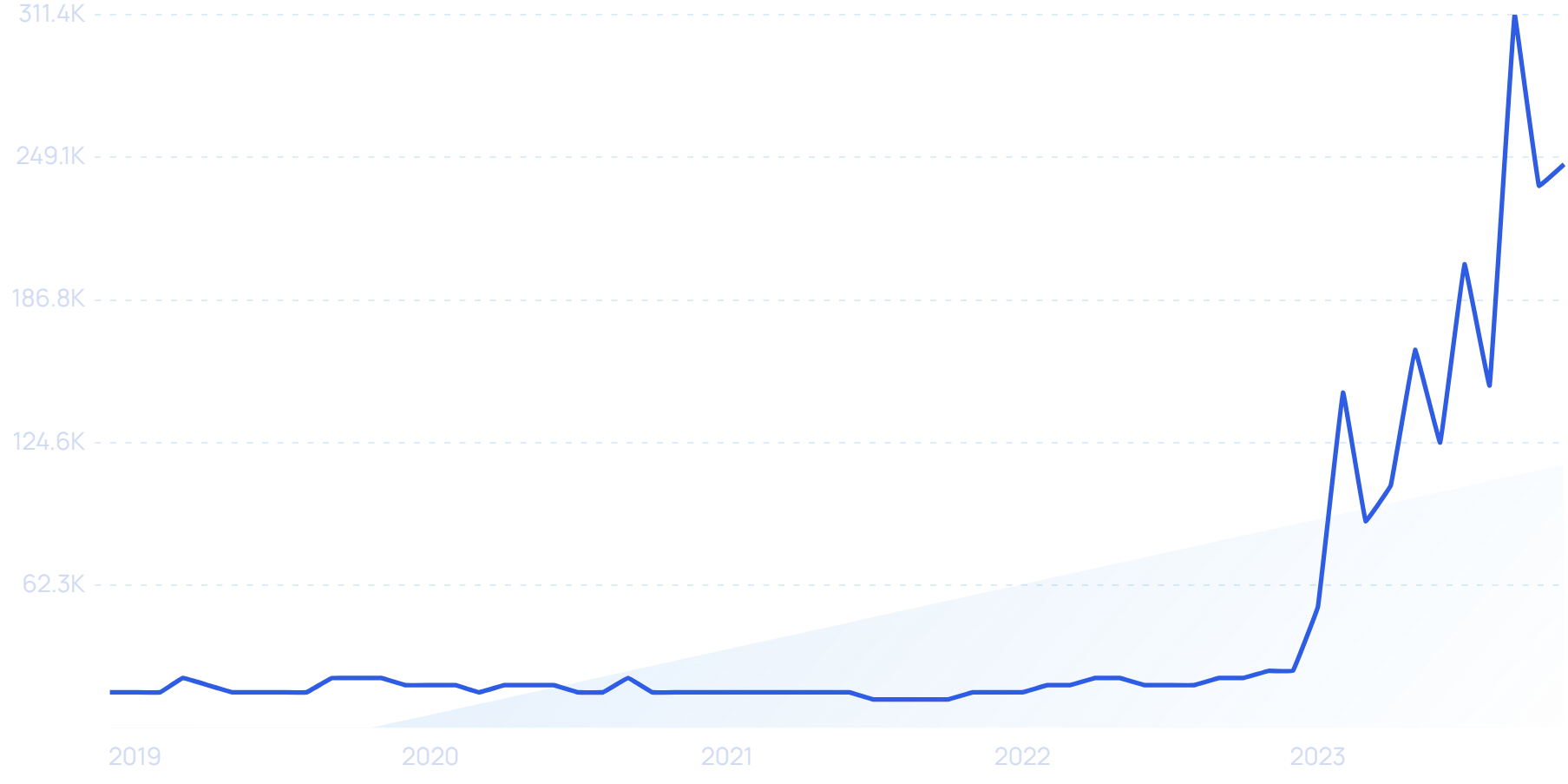

VC funding for generative AI startups has been climbing since 2021.

AI startups saw a dramatic funding surge in 2023. Compared to a measly $770 million in late 2020, total investments skyrocketed to a record-breaking $11 billion by Q2 2023, a 14x increase! This reflects investor enthusiasm for the potential of AI technologies.

OpenAI, a leader in advanced AI models, raked in a whopping $10 billion alone in Q2 2023, highlighting the massive capital flowing towards AI. Other notable deals included:

- $4 billion for Anthropic, an AI safety company, from Amazon. Search interest for Anthropic exploded in 2023, reflecting growing interest in responsible AI development.

- $1.3 billion for Inflection AI, focused on creating AI companions.

- $270 million for Cohere, a specialist in enterprise-grade large language models (LLMs).

However, despite this funding frenzy, some predict a slowdown in generative AI funding for 2024. Here’s why:

- Chip Shortage: There’s a critical lack of high-powered chips needed to train and run powerful AI models, leading to black markets even emerging.

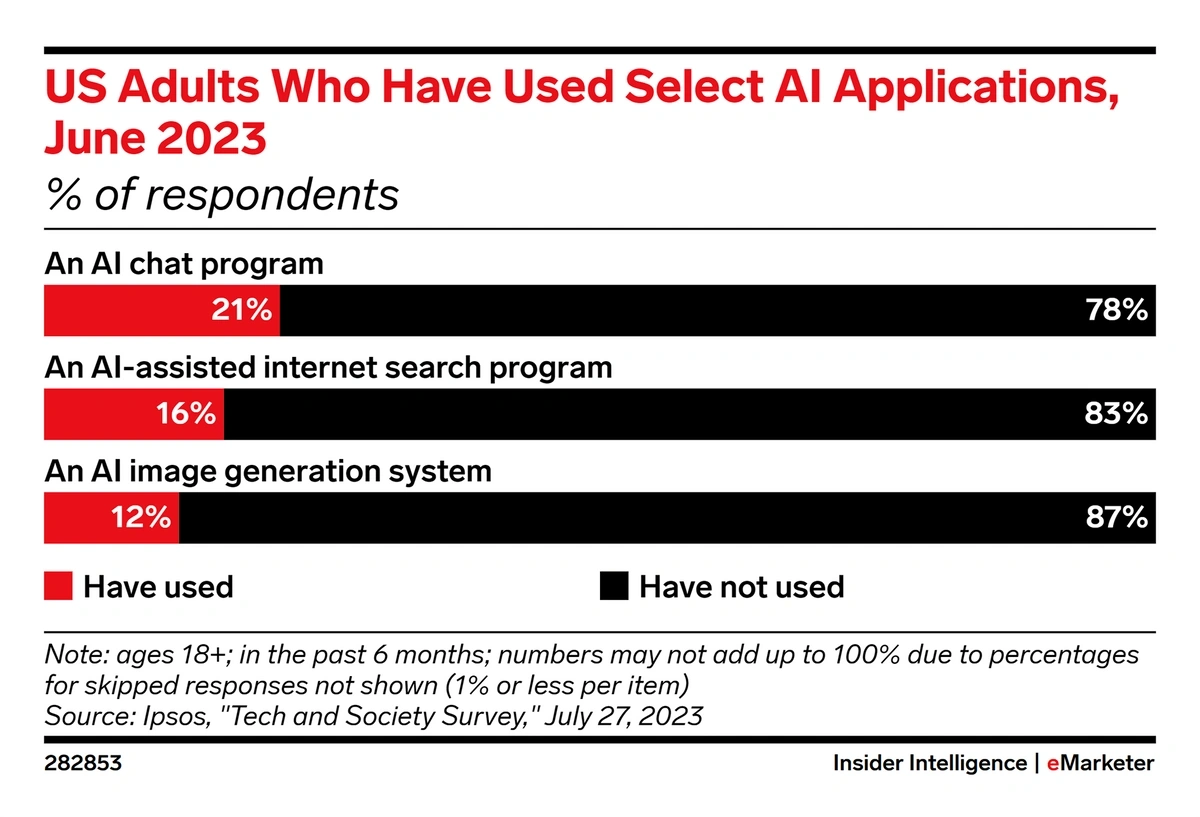

- Uncertain Consumer Demand: Surveys show only 21% of Americans have used an AI program in the past six months, suggesting limited user adoption so far. Over three-quarters haven’t used AI platforms, and only 31% believe society is ready for widespread AI use.

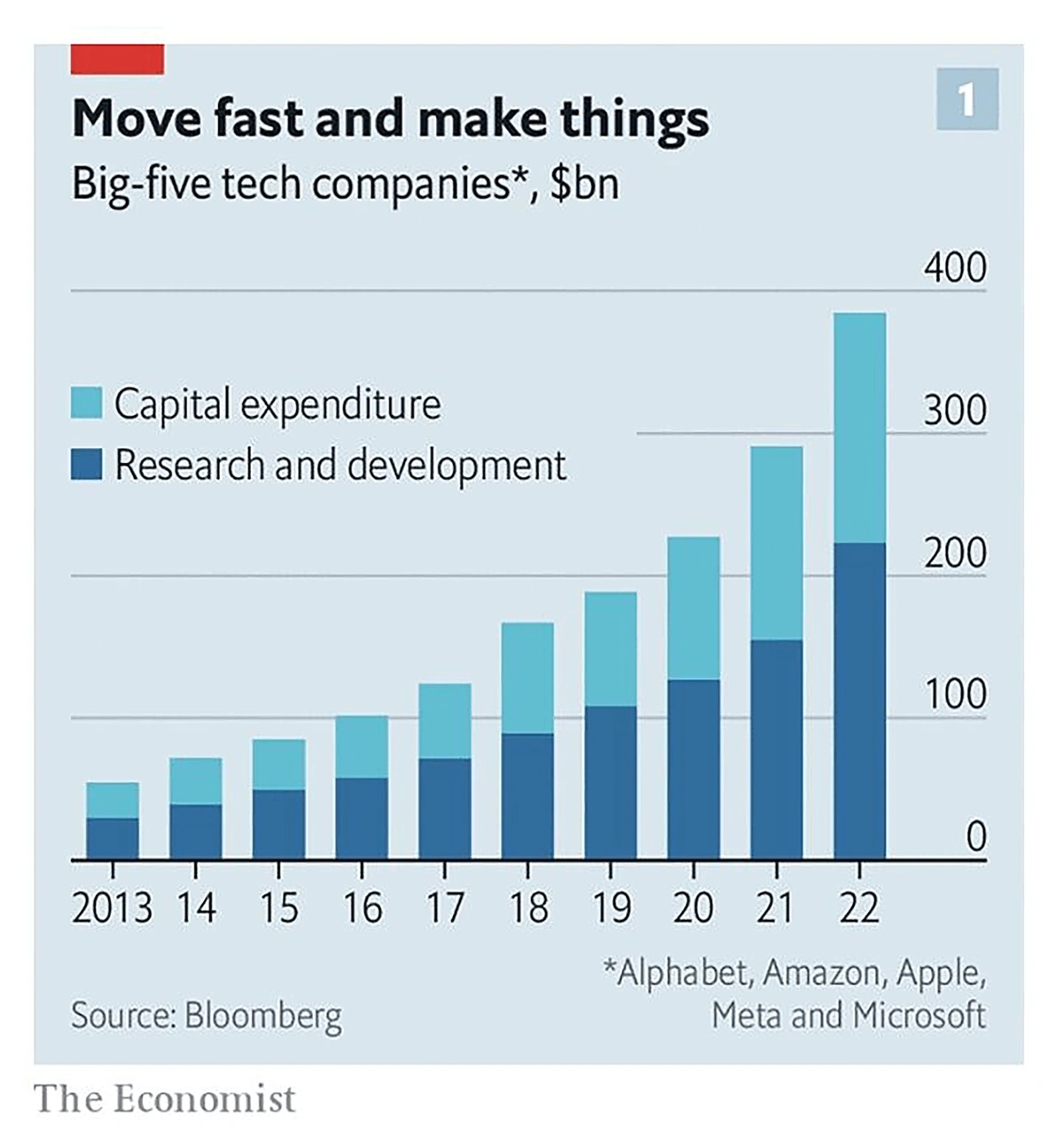

- Big Tech Dominance: Established tech giants like the “Big Five” spent a staggering $223 billion on AI R&D and $161 billion on capital spending in 2022 alone. Their deep pockets and existing infrastructure could pose a challenge for smaller AI startups.

Big Tech Dominance: Established tech giants like the “Big Five” spent a staggering $223 billion on AI R&D and $161 billion on capital spending in 2022 alone. Their deep pockets and existing infrastructure could pose a challenge for smaller AI startups.

Will AI funding continue its meteoric rise, or will these challenges cause a slowdown? Only time will tell.

Trends 11: Caution around hyper-growth business models

The prediction about caution around hyper-growth business models and a shift towards more calculated growth strategies is a reasonable one, given the recent market conditions and investor sentiments.

Here are some key points regarding this trend:

- Lessons from Past Failures: The downfall of several high-profile startups that pursued unsustainable growth at the expense of profitability and sound unit economics has made investors more cautious about backing similar hyper-growth models.

- Emphasis on Profitability: After years of prioritizing growth over profitability, investors are now placing greater emphasis on solid financial metrics, positive unit economics, and a clear path to profitability. Cash-burning models with no clear path to self-sustainability are likely to face increased scrutiny.

- Capital Efficiency: With the potential for tighter funding conditions, startups will need to demonstrate their ability to achieve growth in a capital-efficient manner. Investors will be more inclined to support startups with lean and efficient operations that can scale sustainably.

- Proven Business Models: Startups with proven and repeatable business models that have demonstrated success in generating revenue and achieving profitability are likely to be favored over untested or speculative growth strategies.

- Focus on Fundamentals: Instead of chasing hyper-growth at all costs, startups may be encouraged to focus on fundamentals like product-market fit, customer acquisition and retention, and operational efficiency before pursuing aggressive expansion.

- Regulatory Scrutiny: Increased regulatory scrutiny around anti-competitive practices, predatory pricing, and consumer protection may also contribute to the caution around hyper-growth models that rely on unsustainable pricing or market capture strategies.

- Public Market Expectations: As more startups consider going public, they will need to align their growth strategies with the expectations of public market investors, who typically prioritize profitability and sustainable growth over rapid but unprofitable expansion.

While hyper-growth models may still find support in specific sectors or scenarios where rapid scale is crucial, the overall trend is likely to shift towards more calculated and sustainable growth strategies that prioritize solid unit economics, profitability, and capital efficiency.

Key Takeaways

- Consolidation and Focus on Profitability: Investors are cautious about cash-burning hyper-growth models and will prioritize startups with solid unit economics, a clear profitability path, and calculated growth strategies.

- Increased Early-Stage Funding: The emergence of angel networks in smaller cities and towns is expected to boost early-stage funding as successful entrepreneurs turn investors.

- Emergence of New Sectors: Web 3.0, blockchain, crypto, and climate tech are expected to attract significant investor interest due to their disruptive potential, growing adoption, and importance in decentralized finance, data privacy, and sustainability.

- Decentralization of Startup Activity: New startup hubs are likely to emerge in Tier-2 and Tier-3 cities, driven by talent availability, cost advantages, and government support for regional entrepreneurship.

- Corporate Venture Capital Activity: Large corporations are expected to increase their startup investments through corporate venture capital (CVC) funds, aligning with their innovation goals, access to emerging technologies, and strategic objectives.

- Regional Dispersion of Stakeholders: In addition to the decentralization of startup activity, there is a predicted rise in regional angel networks and a better understanding of local ecosystems by investors outside major metropolitan areas.

India’s startup ecosystem is maturing, focusing on sustainable growth, profitability, and regional hubs. Corporate investors and diverse funding sources contribute to diversity and growth.

Conclusion

The Indian startup trend ecosystem is poised for an exciting phase of evolution and growth, driven by the trends and predictions discussed. As the focus shifts towards sustainable growth, profitability, and calculated expansion strategies, startups will need to adapt and align their business models accordingly.

The emergence of new sectors like Web 3.0, blockchain, crypto, and climate tech presents opportunities for disruptive innovations and attracts investor interest due to their transformative potential. Simultaneously, the decentralization of startup activity and the rise of regional angel networks will contribute to a more inclusive and diverse entrepreneurial landscape.

Venture capital firms and corporate investors will play a crucial role in shaping the future of the ecosystem. Venture studios like Innovations venture studio, which provides funding and support to startups, will be instrumental in nurturing promising ideas and facilitating the growth of innovative businesses.

As the Indian startup ecosystem continues to mature, collaborations between various stakeholders, including entrepreneurs, investors, corporations, and government bodies, will be vital for fostering an environment conducive to innovation and success. The Indian startup community can significantly boost growth and contribute to the global entrepreneurial stage by adapting to changing trends and landscapes.

To navigate the ever-evolving startup landscape and capitalize on emerging opportunities, consider partnering with Manish Khurana and Innovations Venture Studio. With their deep industry knowledge, extensive network, and commitment to nurturing innovative startups, they can provide invaluable guidance and support to help you achieve your entrepreneurial goals. Reach out to Manish Khurana to explore how Innovations Venture Studio can be your trusted ally in driving your startup’s success.